Real World Scenarios

The Problem: Business Continuity

Two partners own a successful tech firm. If one passes away, the surviving partner risks having to work with the deceased partner's spouse, who has no technical experience.

The Trailblazer Solution:

We implemented a Cross-Purchase Buy-Sell Agreement funded by term life insurance. Now, if a partner passes, the insurance provides immediate tax-free cash for the survivor to buy out the shares.

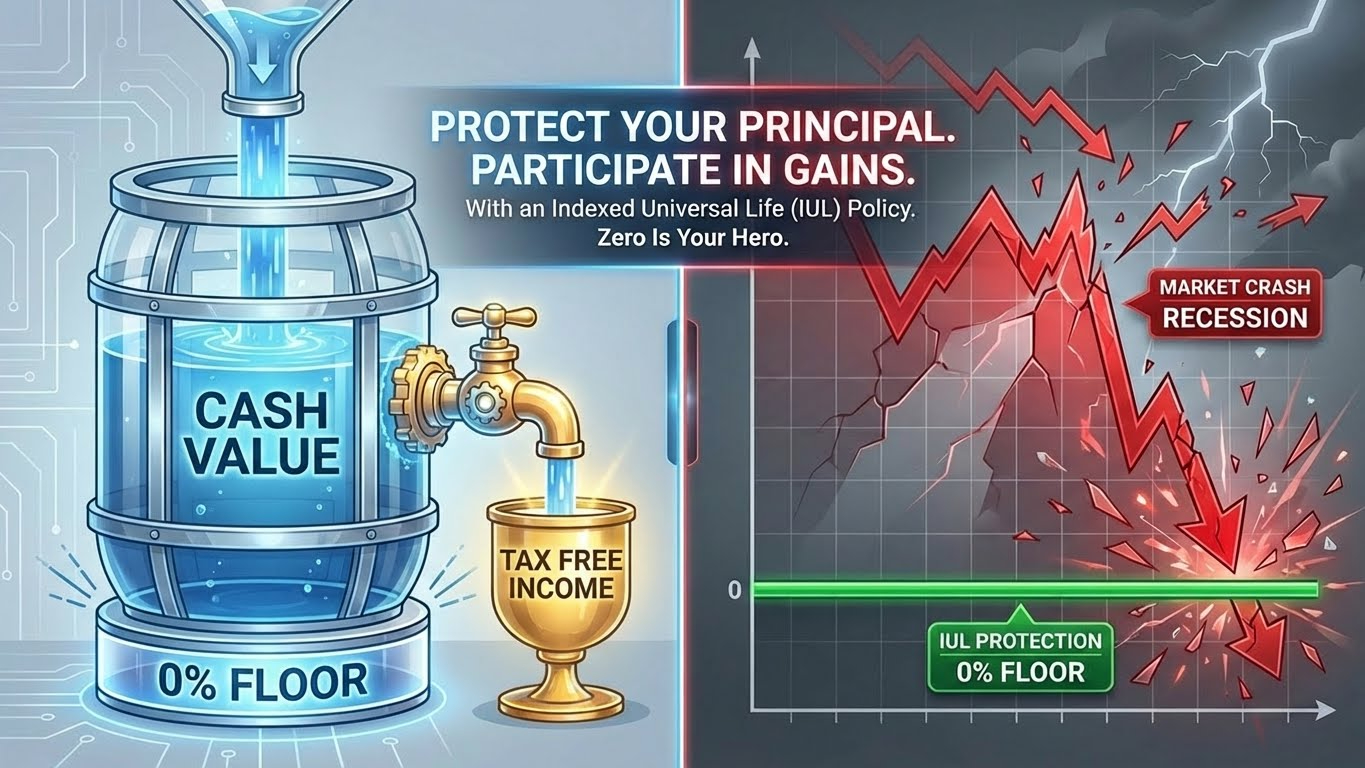

The Problem: Market Risk

Sarah, age 40, watched her 401k drop 20% during the last recession. She wants to grow her retirement savings but cannot afford to lose her principal again.

The Trailblazer Solution:

We structured an Indexed Universal Life (IUL) policy. Her cash value participates in market gains (up to a cap) but has a 0% floor. If the market crashes tomorrow, she loses nothing. Zero is her Hero.